31+ How much mortgage can i qualify

As a general rule your mortgage payment shouldnt exceed one-third of your monthly income. 15 Year Mortgage Rates.

Mortgage Calculator Valley West Mortgage

636a as added by section 1102.

. On June 9 2022 the Bank of Canada released a report that predicted that fixed rates will be at an average of about 45 by 2025. Depending on these factors a person with a 200000 house and a 30-year mortgage may save over 3400 dollars in their first year of owning a home. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Well discuss a few of the requirements unique to owning multiple properties. The Troubled Asset Relief Program TARP is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by President George BushIt was a component of the governments measures in 2009 to address the subprime mortgage crisis.

Once the lender has completed a preliminary review they generally provide a pre-qualification letter that states how much mortgage you qualify for. Before applying for a mortgage you can use our calculator above. The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment.

You must consider the homes price the amount of your deposit and how much you can set aside for monthly mortgage payments. In order to qualify for an FHA-insured mortgage loan youll need to have a minimum credit score of 500. A handy mortgage tax deduction calculator can help you understand what amount youre looking at for your unique situation.

If youre one of those heres how much youll receive and when youll see relief. The piggyback second mortgage can also be financed through an 8020 loan structure. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021.

FHA mortgages usually come in 15 and 30-year fixed rate terms. Stamp Duty break was announced in July 2020 and due to end on March 31 2021. This option is appropriate for first-time homebuyers with less than perfect credit scores.

Mortgage Rates. But to compensate for the low downpayment FHA loans require a mortgage insurance premium. Thinking about buying but not sure where to begin.

You can qualify for PSLF as long as your employer is an eligible nonprofit. This provides a ballpark estimate of the required minimum income to afford a home. This means you have to pay for private mortgage insurance PMI.

A list of state licenses and disclosures is available here. How Much Can I Afford. Gross monthly income is total income from all sources before taxes.

Conventional mortgage guidelines suggest lenders can approve a mortgage if you own up to 10 financed properties. Start with our affordability calculator. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

Section 179 deduction dollar limits. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. To qualify for the loan your front-end and back-end DTI ratios must be within the 2836 DTI limit calculator factors in homeownership.

However these limits can be higher. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. ZGMI is a licensed mortgage broker NMLS 1303160.

So if you make 50000 per year your gross monthly income would be around 4167. As many as 43 million borrowers qualify for student loan forgiveness. -- The sum of the monthly mortgage and monthly tax payments must be less than 31 of your gross pre-taxes monthly salary.

The loan is secured on the borrowers property through a process. How much do houses cost. 2 the term covered mortgage obligation means any indebtedness or debt instrument incurred in the ordinary course of business that-- A is a.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Since your cash on hand is 55000 thats less than 20 of the homes price. A Definitions--In this section-- 1 the term covered loan means a loan guaranteed under paragraph 36 of section 7a of the Small Business Act 15 USC.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. You qualify as a small business taxpayer if you a have average annual gross receipts of 26 million or less for the 3 prior tax years and b are not a tax shelter as defined in section 448d3. This means your monthly payments should be no more than 31 of your pre-tax income and your monthly debts should be less than 43 of your pre-tax income.

This average is actually lower than the current average fixed mortgage rate across Canadas Big 5 Banks as of July 15 2022. You can qualify for an FHA loan if you can make a small downpayment 35 percent of the homes value. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

To understand how this works lets take the example below. Federal loan payments are automatically suspended through Jan. A VA mortgage loan is available to eligible active-duty veteran and reserve military members as well as certain surviving spouses.

Once you have the two numbers and a sense of the interest rate you may qualify for you can use a mortgage calculator to. You may qualify for a loan amount of 252720 and your total monthly mortgage payment will be 1587. Borrowers who may qualify for mortgage deals but with high rates.

How much you ultimately can afford depends on your down payment loan terms taxes and insurance. Stamp Duty Land Tax. Very Poor 0 560.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Two criteria that mortgage lenders look at to understand how much you can afford are the housing expense ratio known as the front-end ratio and the total debt-to-income ratio known as the back-end ratio. Higher credit scores can qualify you for lower down payment requirements as well.

30 Year Mortgage Rates. Lenders will look at much more documentation to determine your ability to qualify for a mortgage on more than one home. To afford a 200K mortgage with a 20 down payment 30-year term and 4 interest rate youd need to make at least 38268 a year before taxes.

2022 the first day that you are entitled to use the property nor beyond the tax year ending December 31 2022 the year following the year. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1 TB of cloud storage. Email and calendar plus so much more.

Should You Skip Mortgage Payments If You Don T Have To

Deployment Checklist Deployment Checklist Army Wife Life

Pin On Bible Study

Payment Plan Agreement Template 21 Free Word Pdf Documents Download Free Payment Agreement Contract Template Lettering

Axos Financial Inc Free Writing Prospectus Fwp

Joseph Sanchez Certified Mortgage Loan Advisor Mortgage Loan Officer Onboard 1 Mortgage Linkedin

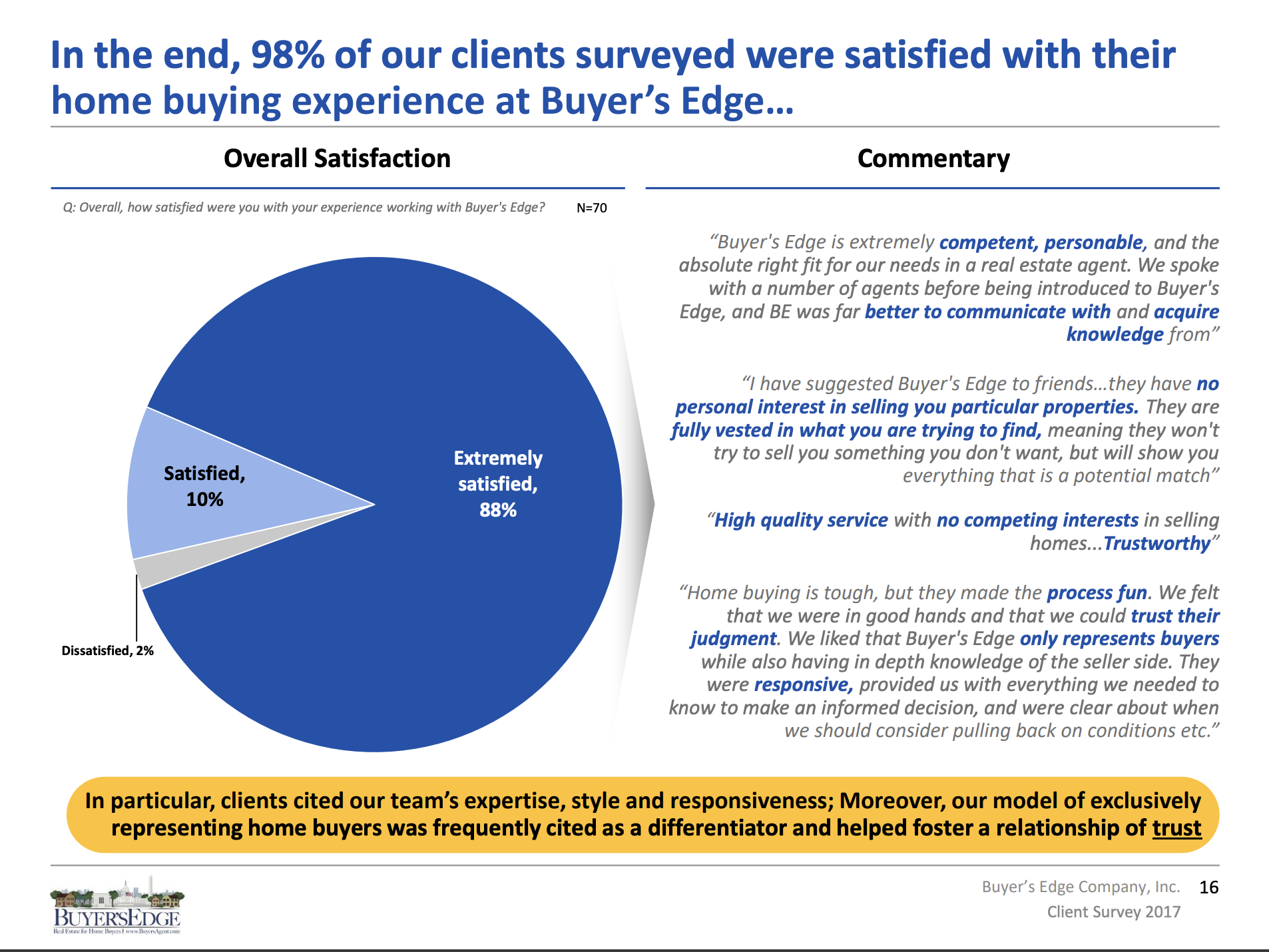

Buyer S Edge Buyersagent Com Home Buying Process Client Feedback Survey True Buyer Agents Dc Md Va Naeba Members Buyer S Edge Buyersagent Com

How To Save Money Fast 3 Tricks Above 1000 Hr

Pin On Savings Side Gigs Financial Success

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

Axos Financial Inc Free Writing Prospectus Fwp

Ryhryr5fviogm

Axos Financial Inc Free Writing Prospectus Fwp

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

Pin On Baby Girl Shoes

![]()

Why Is It Good To Invest In Real Estate Mortgage Magic That S Why

Low Interest Mortgage Rates Nv Ca Co Nm Wa Or Id